What is TFRA?

by Erbe Wealth · Published · Updated

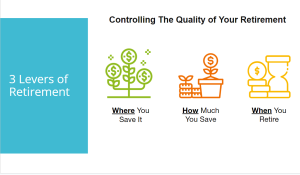

I work with many types of investors from the very high earning to the lower income. And I work with people in ALL age groups. I get the same questions from them… “is there something special, some magical shortcut, I can do to have an amazing retirement?” The answer is there are only 3 levers you can adjust to affect your retirement

- How much you are saving

- How much time you have until retirement

And I believe the most important lever…

- Where you save you money

I work to invest my investors’ money where appropriate in a TFRA. (Tax Free Retirement Account)

Why a TFRA? It’s hands down the best product:

-to have more income in retirement

-to pay as little taxes as possible

-to avoid the roller coaster ride and potential retirement destruction of stock market risk

So, I have found that if we just start with a 5-minute conversation we can uncover pretty quickly whether I can help you with your specific goals or if it would make more sense to point you in a different direction than us.